4. Transactions

Introduction

Transactions are the most important part of the Bitcoin Cash system. Everything else in Bitcoin Cash is designed to ensure that transactions can be created, propagated on the network, validated, and finally added to the global ledger of transactions (the blockchain). Transactions are data structures that encode the transfer of value between participants in the Bitcoin Cash system. Each transaction is a public entry in Bitcoin Cash’s blockchain, the global double-entry bookkeeping ledger.

In this chapter we will examine all the various forms of transactions, what they contain, how to create them, how they are verified, and how they become part of the permanent record of all transactions.

Transaction Lifecycle

A transaction’s lifecycle starts with the transaction’s creation, also known as origination. The transaction is then signed with one or more signatures indicating the authorization to spend the funds referenced by the transaction. The transaction is then broadcast on the Bitcoin Cash network, where each network node (participant) validates and propagates the transaction until it reaches (almost) every node in the network. Finally, the transaction is verified by a mining node and included in a block of transactions that is recorded on the blockchain.

Once recorded on the blockchain and confirmed by sufficient subsequent blocks (confirmations), the transaction is a permanent part of the Bitcoin Cash ledger and is accepted as valid by all participants. The funds allocated to a new owner by the transaction can then be spent in a new transaction, extending the chain of ownership and beginning the lifecycle of a transaction again.

Creating Transactions

In some ways it helps to think of a transaction in the same way as a paper check. Like a check, a transaction is an instrument that expresses the intent to transfer money and is not visible to the financial system until it is submitted for execution. Like a check, the originator of the transaction does not have to be the one signing the transaction.

Transactions can be created online or offline by anyone, even if the person creating the transaction is not an authorized signer on the account. For example, an accounts payable clerk might process payable checks for signature by the CEO. Similarly, an accounts payable clerk can create Bitcoin Cash transactions and then have the CEO apply digital signatures to make them valid. Whereas a check references a specific account as the source of the funds, a Bitcoin Cash transaction references a specific previous transaction as its source, rather than an account.

Once a transaction has been created, it is signed by the owner (or owners) of the source funds. If it is properly formed and signed, the signed transaction is now valid and contains all the information needed to execute the transfer of funds. Finally, the valid transaction has to reach the Bitcoin Cash network so that it can be propagated until it reaches a miner for inclusion in the pubic ledger (the blockchain).

Broadcasting Transactions to the Bitcoin Cash Network

First, a transaction needs to be delivered to the Bitcoin Cash network so that it can be propagated and included in the blockchain. In essence, a Bitcoin Cash transaction is just 300 to 400 bytes of data and has to reach any one of tens of thousands of Bitcoin Cash nodes. The senders do not need to trust the nodes they use to broadcast the transaction, as long as they use more than one to ensure that it propagates. The nodes don’t need to trust the sender or establish the sender’s “identity.” Because the transaction is signed and contains no confidential information, private keys, or credentials, it can be publicly broadcast using any underlying network transport that is convenient. Unlike credit card transactions, for example, which contain sensitive information and can only be transmitted on encrypted networks, a Bitcoin Cash transaction can be sent over any network. As long as the transaction can reach a Bitcoin Cash node that will propagate it into the Bitcoin Cash network, it doesn’t matter how it is transported to the first node.

Bitcoin Cash transactions can therefore be transmitted to the Bitcoin Cash network over insecure networks such as WiFi, Bluetooth, NFC, Chirp, barcodes, or by copying and pasting into a web form. In extreme cases, a Bitcoin Cash transaction could be transmitted over packet radio, satellite relay, or shortwave using burst transmission, spread spectrum, or frequency hopping to evade detection and jamming. A Bitcoin Cash transaction could even be encoded as smileys (emoticons) and posted in a public forum or sent as a text message or Skype chat message. Bitcoin Cash has turned money into a data structure, making it virtually impossible to stop anyone from creating and executing a Bitcoin Cash transaction.

Propagating Transactions on the Bitcoin Cash Network

Once a Bitcoin Cash transaction is sent to any node connected to the Bitcoin Cash network, the transaction will be validated by that node. If valid, that node will propagate it to the other nodes to which it is connected, and a success message will be returned synchronously to the originator. If the transaction is invalid, the node will reject it and synchronously return a rejection message to the originator.

The Bitcoin Cash network is a peer-to-peer network, meaning that each Bitcoin Cash node is connected to a few other Bitcoin Cash nodes that it discovers during startup through the peer-to-peer protocol. The entire network forms a loosely connected mesh without a fixed topology or any structure, making all nodes equal peers. Messages, including transactions and blocks, are propagated from each node to all the peers to which it is connected, a process called “flooding.” A new validated transaction injected into any node on the network will be sent to all of the nodes connected to it (neighbors), each of which will send the transaction to all its neighbors, and so on. In this way, within a few seconds a valid transaction will propagate in an exponentially expanding ripple across the network until all nodes in the network have received it.

The Bitcoin Cash network is designed to propagate transactions and blocks to all nodes in an efficient and resilient manner that is resistant to attacks. To prevent spamming, denial-of-service attacks, or other nuisance attacks against the Bitcoin Cash system, every node independently validates every transaction before propagating it further. A malformed transaction will not get beyond one node.

Transaction Structure

A transaction is a data structure that encodes a transfer of value from a source of funds, called an input, to a destination, called an output. Transaction inputs and outputs are not related to accounts or identities. Instead, you should think of them as Bitcoin Cash amounts—chunks of Bitcoin Cash—being locked with a specific secret that only the owner, or person who knows the secret, can unlock. A transaction contains a number of fields, as shown in The structure of a transaction.

| Size | Field | Description |

|---|---|---|

| 4 bytes | Version | Specifies which rules this transaction follows |

| 1–9 bytes (VarInt) | Input Counter | How many inputs are included |

| Variable | Inputs | One or more transaction inputs |

| 1–9 bytes (VarInt) | Output Counter | How many outputs are included |

| variable | Outputs | One or more transaction outputs |

| 4 bytes | Locktime | A Unix timestamp or block number |

Transaction Locktime

Locktime, also known as nLockTime from the variable name used in the reference client, defines the earliest time that a transaction is valid and can be relayed on the network or added to the blockchain. It is set to zero in most transactions to indicate immediate propagation and execution. If locktime is nonzero and below 500 million, it is interpreted as a block height, meaning the transaction is not valid and is not relayed or included in the blockchain prior to the specified block height. If it is above 500 million, it is interpreted as a Unix Epoch timestamp (seconds since Jan-1-1970) and the transaction is not valid prior to the specified time. Transactions with locktime specifying a future block or time must be held by the originating system and transmitted to the Bitcoin Cash network only after they become valid. The use of locktime is equivalent to postdating a paper check.

Transaction Outputs and Inputs

The fundamental building block of a Bitcoin Cash transaction is an unspent transaction output, or UTXO. UTXO are indivisible chunks of Bitcoin Cash currency locked to a specific owner, recorded on the blockchain, and recognized as currency units by the entire network. The Bitcoin Cash network tracks all available (unspent) UTXO currently numbering in the millions. Whenever a user receives Bitcoin Cash, that amount is recorded within the blockchain as a UTXO. Thus, a user’s Bitcoin Cash might be scattered as UTXO amongst hundreds of transactions and hundreds of blocks. In effect, there is no such thing as a stored balance of a Bitcoin Cash address or account; there are only scattered UTXO, locked to specific owners. The concept of a user’s Bitcoin Cash balance is a derived construct created by the wallet application. The wallet calculates the user’s balance by scanning the blockchain and aggregating all UTXO belonging to that user.

A UTXO can have an arbitrary value denominated as a multiple of satoshis. Just like dollars can be divided down to two decimal places as cents, bitcoins can be divided down to eight decimal places as satoshis. Although UTXO can be any arbitrary value, once created it is indivisible just like a coin that cannot be cut in half. If a UTXO is larger than the desired value of a transaction, it must still be consumed in its entirety and change must be generated in the transaction. In other words, if you have a 20 Bitcoin Cash UTXO and want to pay 1 Bitcoin Cash, your transaction must consume the entire 20 Bitcoin Cash UTXO and produce two outputs: one paying 1 Bitcoin Cash to your desired recipient and another paying 19 Bitcoin Cash in change back to your wallet. As a result, most Bitcoin Cash transactions will generate change.

Imagine a shopper buying a $1.50 beverage, reaching into her wallet and trying to find a combination of coins and bank notes to cover the $1.50 cost. The shopper will choose exact change if available (a dollar bill and two quarters), or a combination of smaller denominations (six quarters), or if necessary, a larger unit such as a five dollar bank note. If she hands too much money, say $5, to the shop owner, she will expect $3.50 change, which she will return to her wallet and have available for future transactions.

Similarly, a Bitcoin Cash transaction must be created from a user’s UTXO in whatever denominations that user has available. Users cannot cut a UTXO in half any more than they can cut a dollar bill in half and use it as currency. The user’s wallet application will typically select from the user’s available UTXO various units to compose an amount greater than or equal to the desired transaction amount.

As with real life, the Bitcoin Cash application can use several strategies to satisfy the purchase amount: combining several smaller units, finding exact change, or using a single unit larger than the transaction value and making change. All of this complex assembly of spendable UTXO is done by the user’s wallet automatically and is invisible to users. It is only relevant if you are programmatically constructing raw transactions from UTXO.

The UTXO consumed by a transaction are called transaction inputs, and the UTXO created by a transaction are called transaction outputs. This way, chunks of Bitcoin Cash value move forward from owner to owner in a chain of transactions consuming and creating UTXO. Transactions consume UTXO by unlocking it with the signature of the current owner and create UTXO by locking it to the Bitcoin Cash address of the new owner.

The exception to the output and input chain is a special type of transaction called the coinbase transaction, which is the first transaction in each block. This transaction is placed there by the “winning” miner and creates brand-new Bitcoin Cash payable to that miner as a reward for mining. This is how Bitcoin Cash’s money supply is created during the mining process, as we will see in Mining and Consensus.

Transaction Outputs

Every Bitcoin Cash transaction creates outputs, which are recorded on the Bitcoin Cash ledger. Almost all of these outputs, with one exception (see Data Output (OP_RETURN)) create spendable chunks of Bitcoin Cash called unspent transaction outputs or UTXO, which are then recognized by the whole network and available for the owner to spend in a future transaction. Sending someone Bitcoin Cash is creating an unspent transaction output (UTXO) registered to their address and available for them to spend.

UTXO are tracked by every full-node Bitcoin Cash client as a data set called the UTXO set or UTXO pool, held in a database. New transactions consume (spend) one or more of these outputs from the UTXO set.

Transaction outputs consist of two parts:

- An amount of Bitcoin Cash, denominated in satoshis, the smallest Bitcoin Cash unit

- A locking script, also known as an “encumbrance” that “locks” this amount by specifying the conditions that must be met to spend the output

The transaction scripting language, used in the locking script mentioned previously, is discussed in detail in Transaction Scripts and Script Language. The structure of a transaction output shows the structure of a transaction output.

| Size | Field | Description |

|---|---|---|

| 8 bytes | Amount | Bitcoin Cash value in satoshis (108 Bitcoin Cash) |

| 1–9 bytes (VarInt) | Locking-Script Size | Locking-Script length in bytes, to follow |

| Variable | Locking-Script | A script defining the conditions needed to spend the output |

| 1–9 bytes (VarInt) | Output Counter | How many outputs are included |

| variable | Outputs | One or more transaction outputs |

| 4 bytes | Locktime | A Unix timestamp or block number |

In A script that calls bitbox.Address.utxo to find the UTXO related to an address, we use the bitbox.Address class to find the unspent outputs (UTXO) of a specific address.

bitbox.Address.utxo('bitcoincash:qpcxf2sv9hjw08nvpgffpamfus9nmksm3chv5zqtnz').then((result) => {

console.log(result);

}, (err) => {

console.log(err);

});

Returns the following:

[{ txid:

'cc27be8846276612dfce5924b7be96556212f0f0e62bd17641732175edb9911e',

vout: 0,

scriptPubKey: '76a9147064aa0c2de4e79e6c0a1290f769e40b3dda1b8e88ac',

amount: 0.00007021,

satoshis: 7021,

height: 527155,

confirmations: 11879,

legacyAddress: '1BFHGm4HzqgXXyNX8n7DsQno5DAC4iLMRA',

cashAddress: 'bitcoincash:qpcxf2sv9hjw08nvpgffpamfus9nmksm3chv5zqtnz' } ]

Running the script, we see an array of objects representing unspent transaction outputs which are available to this address.

Spending conditions (encumbrances)

Transaction outputs associate a specific amount (in satoshis) to a specific encumbrance or locking script that defines the condition that must be met to spend that amount. In most cases, the locking script will lock the output to a specific Bitcoin Cash address, thereby transferring ownership of that amount to the new owner. When Alice paid Bob’s Cafe for a cup of coffee, her transaction created a 0.00208507 Bitcoin Cash output encumbered or locked to the cafe’s Bitcoin Cash address. That 0.00208507 Bitcoin Cash output was recorded on the blockchain and became part of the Unspent Transaction Output set, meaning it showed in Bob’s wallet as part of the available balance. When Bob chooses to spend that amount, his transaction will release the encumbrance, unlocking the output by providing an unlocking script containing a signature from Bob’s private key.

Transaction Inputs

In simple terms, transaction inputs are pointers to UTXO. They point to a specific UTXO by reference to the transaction hash and sequence number where the UTXO is recorded in the blockchain. To spend UTXO, a transaction input also includes unlocking scripts that satisfy the spending conditions set by the UTXO. The unlocking script is usually a signature proving ownership of the Bitcoin Cash address that is in the locking script.

When users make a payment, their wallet constructs a transaction by selecting from the available UTXO. For example, to make a 0.00208507 Bitcoin Cash payment, the wallet app may select a 0.002 UTXO and a 0.00008507 UTXO, using them both to add up to the desired payment amount.

Once the UTXO is selected, the wallet then produces unlocking scripts containing signatures for each of the UTXO, thereby making them spendable by satisfying their locking script conditions. The wallet adds these UTXO references and unlocking scripts as inputs to the transaction. The structure of a transaction input shows the structure of a transaction input.

| Size | Field | Description |

|---|---|---|

| 32 bytes | Transaction Hash | Pointer to the transaction containing the UTXO to be spent |

| 4 bytes | Output Index | The index number of the UTXO to be spent; first one is 0 |

| 1-9 bytes (VarInt) | Unlocking-Script Size | Unlocking-Script length in bytes, to follow |

| Variable | Unlocking-Script | A script that fulfills the conditions of the UTXO locking script |

| 4 bytes | Sequence Number | Currently disabled Tx-replacement feature, set to 0xFFFFFFFF |

Transaction Fees

Most transactions include transaction fees, which compensate the Bitcoin Cash miners for securing the network. Mining and the fees and rewards collected by miners are discussed in more detail in Mining and Consensus. This section examines how transaction fees are included in a typical transaction. Most wallets calculate and include transaction fees automatically. However, if you are constructing transactions programmatically, or using a command-line interface, you must manually account for and include these fees.

Transaction fees serve as an incentive to include (mine) a transaction into the next block and also as a disincentive against “spam” transactions or any kind of abuse of the system, by imposing a small cost on every transaction. Transaction fees are collected by the miner who mines the block that records the transaction on the blockchain.

Transaction fees are calculated based on the size of the transaction in kilobytes, not the value of the transaction in Bitcoin Cash. Overall, transaction fees are set based on market forces within the Bitcoin Cash network. Miners prioritize transactions based on many different criteria, including fees, and might even process transactions for free under certain circumstances. Transaction fees affect the processing priority, meaning that a transaction with sufficient fees is likely to be included in the next-most–mined block, whereas a transaction with insufficient or no fees might be delayed, processed on a best-effort basis after a few blocks, or not processed at all. Transaction fees are not mandatory, and transactions without fees might be processed eventually; however, including transaction fees encourages priority processing.

The current algorithm used by miners to prioritize transactions for inclusion in a block based on their fees is examined in detail in Mining and Consensus.

Adding Fees to Transactions

The data structure of transactions does not have a field for fees. Instead, fees are implied as the difference between the sum of inputs and the sum of outputs. Any excess amount that remains after all outputs have been deducted from all inputs is the fee that is collected by the miners.

Transaction fees are implied, as the excess of inputs minus outputs:

Fees = Sum(Inputs) – Sum(Outputs)

This is a somewhat confusing element of transactions and an important point to understand, because if you are constructing your own transactions you must ensure you do not inadvertently include a very large fee by underspending the inputs. That means that you must account for all inputs, if necessary by creating change, or you will end up giving the miners a very big tip!

For example, if you consume a 20-Bitcoin Cash UTXO to make a 1-Bitcoin Cash payment, you must include a 19-Bitcoin Cash change output back to your wallet. Otherwise, the 19-Bitcoin Cash “leftover” will be counted as a transaction fee and will be collected by the miner who mines your transaction in a block. Although you will receive priority processing and make a miner very happy, this is probably not what you intended.

Let’s see how this works in practice, by looking at Alice’s coffee purchase again. Alice wants to spend 0.00208507 Bitcoin Cash to pay for coffee. To ensure this transaction is processed promptly, she will want to include a transaction fee of 1 satoshi per byte. That will mean that the total cost of the transaction will be 0.00208750. Her wallet must therefore source a set of UTXO that adds up to 0.00208750 Bitcoin Cash or more and, if necessary, create change. Let’s say her wallet has a 0.00277257-Bitcoin Cash UTXO available. It will therefore need to consume this UTXO, create one output to Bob’s Cafe for 0.00208507, and a second output with 0.00068507 Bitcoin Cash in change back to her own wallet, leaving 0.00000243 Bitcoin Cash unallocated, as an implicit fee for the transaction.

Transaction Chaining and Orphan Transactions

As we have seen, transactions form a chain, whereby one transaction spends the outputs of the previous transaction (known as the parent) and creates outputs for a subsequent transaction (known as the child). Sometimes an entire chain of transactions depending on each other—say a parent, child, and grandchild transaction—are created at the same time, to fulfill a complex transactional workflow that requires valid children to be signed before the parent is signed.

When a chain of transactions is transmitted across the network, they don’t always arrive in the same order. Sometimes, the child might arrive before the parent. In that case, the nodes that see a child first can see that it references a parent transaction that is not yet known. Rather than reject the child, they put it in a temporary pool to await the arrival of its parent and propagate it to every other node. The pool of transactions without parents is known as the orphan transaction pool. Once the parent arrives, any orphans that reference the UTXO created by the parent are released from the pool, revalidated recursively, and then the entire chain of transactions can be included in the transaction pool, ready to be mined in a block. Transaction chains can be arbitrarily long, with any number of generations transmitted simultaneously. The mechanism of holding orphans in the orphan pool ensures that otherwise valid transactions will not be rejected just because their parent has been delayed and that eventually the chain they belong to is reconstructed in the correct order, regardless of the order of arrival.

There is a limit to the number of orphan transactions stored in memory, to prevent a denial-of-service attack against Bitcoin Cash nodes. The limit is defined as MAX_ORPHAN_TRANSACTIONS in the source code of the Bitcoin Cash reference client. If the number of orphan transactions in the pool exceeds MAX_ORPHAN_TRANSACTIONS, one or more randomly selected orphan transactions are evicted from the pool, until the pool size is back within limits.

Transaction Scripts and Script Language

Bitcoin Cash clients validate transactions by executing a script, written in a Forth-like scripting language. Both the locking script (encumbrance) placed on a UTXO and the unlocking script that usually contains a signature are written in this scripting language. When a transaction is validated, the unlocking script in each input is executed alongside the corresponding locking script to see if it satisfies the spending condition.

Today, most transactions processed through the Bitcoin Cash network have the form “Alice pays Bob” and are based on the same script called a Pay-to-Public-Key-Hash script. However, the use of scripts to lock outputs and unlock inputs means that through use of the programming language, transactions can contain an infinite number of conditions. Bitcoin Cash transactions are not limited to the “Alice pays Bob” form and pattern.

This is only the tip of the iceberg of possibilities that can be expressed with this scripting language. In this section, we will demonstrate the components of the Bitcoin Cash transaction scripting language and show how it can be used to express complex conditions for spending and how those conditions can be satisfied by unlocking scripts.

Script Construction (Lock + Unlock)

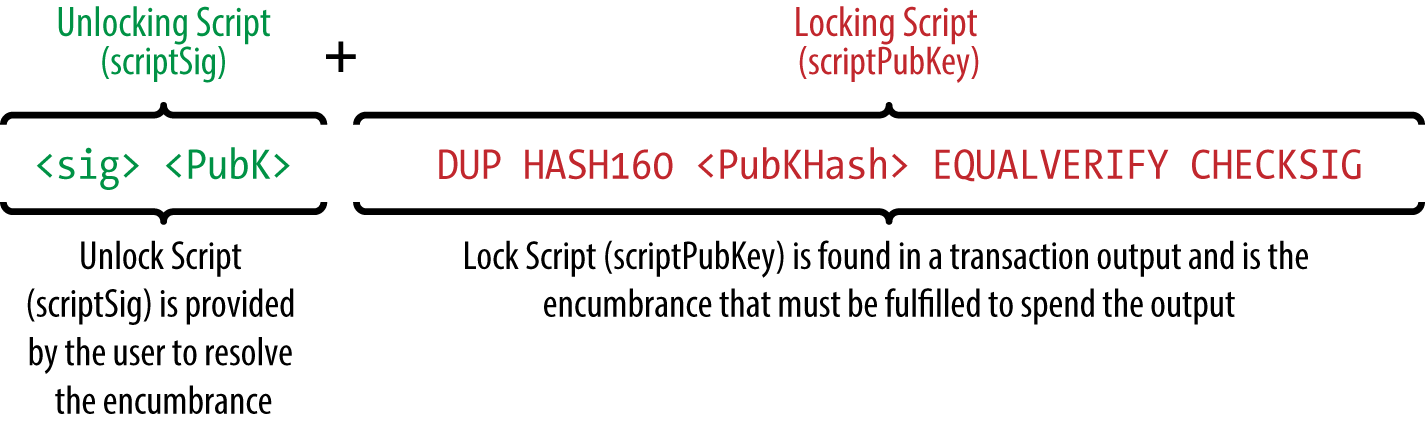

Bitcoin Cash’s transaction validation engine relies on two types of scripts to validate transactions: a locking script and an unlocking script.

A locking script is an encumbrance placed on an output, and it specifies the conditions that must be met to spend the output in the future. Historically, the locking script was called a scriptPubKey, because it usually contained a public key or Bitcoin Cash address. In this book we refer to it as a “locking script” to acknowledge the much broader range of possibilities of this scripting technology. In most Bitcoin Cash applications, what we refer to as a locking script will appear in the source code as scriptPubKey.

An unlocking script is a script that “solves,” or satisfies, the conditions placed on an output by a locking script and allows the output to be spent. Unlocking scripts are part of every transaction input, and most of the time they contain a digital signature produced by the user’s wallet from his or her private key. Historically, the unlocking script is called scriptSig, because it usually contained a digital signature. In most Bitcoin Cash applications, the source code refers to the unlocking script as scriptSig. In this book, we refer to it as an “unlocking script” to acknowledge the much broader range of locking script requirements, because not all unlocking scripts must contain signatures.

Every Bitcoin Cash client will validate transactions by executing the locking and unlocking scripts together. For each input in the transaction, the validation software will first retrieve the UTXO referenced by the input. That UTXO contains a locking script defining the conditions required to spend it. The validation software will then take the unlocking script contained in the input that is attempting to spend this UTXO and execute the two scripts.

In the original Bitcoin Cash client, the unlocking and locking scripts were concatenated and executed in sequence. For security reasons, this was changed in 2010, because of a vulnerability that allowed a malformed unlocking script to push data onto the stack and corrupt the locking script. In the current implementation, the scripts are executed separately with the stack transferred between the two executions, as described next.

First, the unlocking script is executed, using the stack execution engine. If the unlocking script executed without errors (e.g., it has no “dangling” operators left over), the main stack (not the alternate stack) is copied and the locking script is executed. If the result of executing the locking script with the stack data copied from the unlocking script is “TRUE,” the unlocking script has succeeded in resolving the conditions imposed by the locking script and, therefore, the input is a valid authorization to spend the UTXO. If any result other than “TRUE” remains after execution of the combined script, the input is invalid because it has failed to satisfy the spending conditions placed on the UTXO. Note that the UTXO is permanently recorded in the blockchain, and therefore is invariable and is unaffected by failed attempts to spend it by reference in a new transaction. Only a valid transaction that correctly satisfies the conditions of the UTXO results in the UTXO being marked as “spent” and removed from the set of available (unspent) UTXO.

Combining scriptSig and scriptPubKey to evaluate a transaction script is an example of the unlocking and locking scripts for the most common type of Bitcoin Cash transaction (a payment to a public key hash), showing the combined script resulting from the concatenation of the unlocking and locking scripts prior to script validation.

Scripting Language

The Bitcoin Cash transaction script language, called Script, is a Forth-like reverse-polish notation stack-based execution language. If that sounds like gibberish, you probably haven’t studied 1960’s programming languages. Script is a very simple language that was designed to be limited in scope and executable on a range of hardware, perhaps as simple as an embedded device, such as a handheld calculator. It requires minimal processing and cannot do many of the fancy things modern programming languages can do. In the case of programmable money, that is a deliberate security feature.

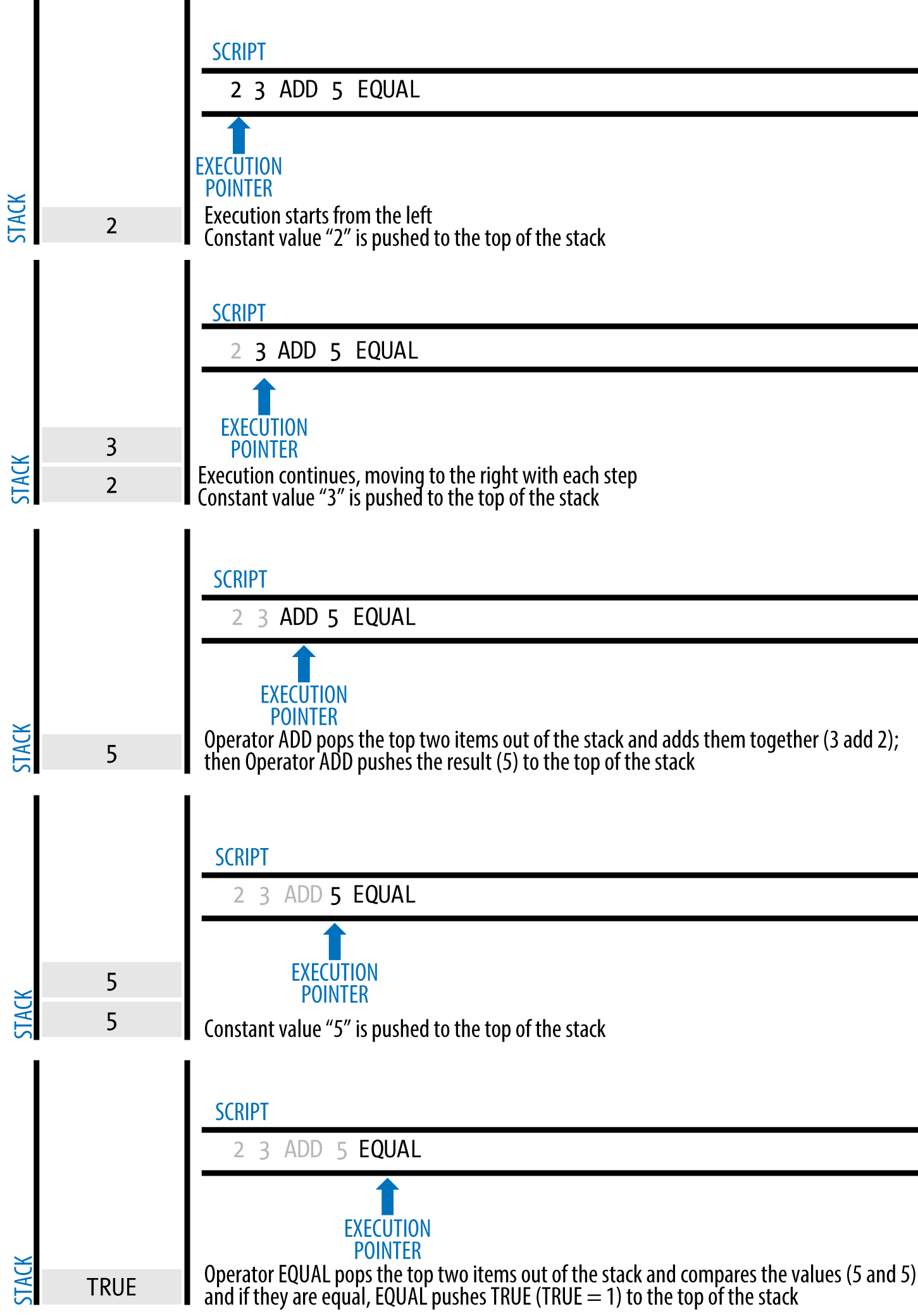

Bitcoin Cash’s scripting language is called a stack-based language because it uses a data structure called a stack. A stack is a very simple data structure, which can be visualized as a stack of cards. A stack allows two operations: push and pop. Push adds an item on top of the stack. Pop removes the top item from the stack.

The scripting language executes the script by processing each item from left to right. Numbers (data constants) are pushed onto the stack. Operators push or pop one or more parameters from the stack, act on them, and might push a result onto the stack. For example, OP_ADD will pop two items from the stack, add them, and push the resulting sum onto the stack.

Conditional operators evaluate a condition, producing a boolean result of TRUE or FALSE. For example, OP_EQUAL pops two items from the stack and pushes TRUE (TRUE is represented by the number 1) if they are equal or FALSE (represented by zero) if they are not equal. Bitcoin Cash transaction scripts usually contain a conditional operator, so that they can produce the TRUE result that signifies a valid transaction.

In Bitcoin Cash’s script validation doing simple math, the script 2 3 OP_ADD 5 OP_EQUAL demonstrates the arithmetic addition operator OP_ADD, adding two numbers and putting the result on the stack, followed by the conditional operator OP_EQUAL, which checks that the resulting sum is equal to 5. For brevity, the OP_ prefix is omitted in the step-by-step example.

The following is a slightly more complex script, which calculates 2 + 7 – 3 + 1. Notice that when the script contains several operators in a row, the stack allows the results of one operator to be acted upon by the next operator:

2 7 OP_ADD 3 OP_SUB 1 OP_ADD 7 OP_EQUAL

Try validating the preceding script yourself using pencil and paper. When the script execution ends, you should be left with the value TRUE on the stack.

Although most locking scripts refer to a Bitcoin Cash address or public key, thereby requiring proof of ownership to spend the funds, the script does not have to be that complex. Any combination of locking and unlocking scripts that results in a TRUE value is valid. The simple arithmetic we used as an example of the scripting language is also a valid locking script that can be used to lock a transaction output.

Use part of the arithmetic example script as the locking script:

3 OP_ADD 5 OP_EQUAL

which can be satisfied by a transaction containing an input with the unlocking script:

2

The validation software combines the locking and unlocking scripts and the resulting script is:

2 3 OP_ADD 5 OP_EQUAL

As we saw in the step-by-step example in Bitcoin Cash’s script validation doing simple math, when this script is executed, the result is OP_TRUE, making the transaction valid. Not only is this a valid transaction output locking script, but the resulting UTXO could be spent by anyone with the arithmetic skills to know that the number 2 satisfies the script.

Turing Incompleteness

The Bitcoin Cash transaction script language contains many operators, but is deliberately limited in one important way—there are no loops or complex flow control capabilities other than conditional flow control. This ensures that the language is not Turing Complete, meaning that scripts have limited complexity and predictable execution times. Script is not a general-purpose language. These limitations ensure that the language cannot be used to create an infinite loop or other form of “logic bomb” that could be embedded in a transaction in a way that causes a denial-of-service attack against the Bitcoin Cash network. Remember, every transaction is validated by every full node on the Bitcoin Cash network. A limited language prevents the transaction validation mechanism from being used as a vulnerability.

Stateless Verification

The Bitcoin Cash transaction script language is stateless, in that there is no state prior to execution of the script, or state saved after execution of the script. Therefore, all the information needed to execute a script is contained within the script. A script will predictably execute the same way on any system. If your system verifies a script, you can be sure that every other system in the Bitcoin Cash network will also verify the script, meaning that a valid transaction is valid for everyone and everyone knows this. This predictability of outcomes is an essential benefit of the Bitcoin Cash system.

Standard Transactions

In the first few years of Bitcoin Cash’s development, the developers introduced some limitations in the types of scripts that could be processed by the reference client. These limitations are encoded in a function called isStandard(), which defines five types of “standard” transactions. These limitations are temporary and might be lifted by the time you read this. Until then, the five standard types of transaction scripts are the only ones that will be accepted by the reference client and most miners who run the reference client. Although it is possible to create a nonstandard transaction containing a script that is not one of the standard types, you must find a miner who does not follow these limitations to mine that transaction into a block.

Check the source code of the Bitcoin Core client (the reference implementation) to see what is currently allowed as a valid transaction script.

The five standard types of transaction scripts are pay-to-public-key-hash (P2PKH), public-key, multi-signature (limited to 15 keys), pay-to-script-hash (P2SH), and data output (OP_RETURN), which are described in more detail in the following sections.

Pay-to-Public-Key-Hash (P2PKH)

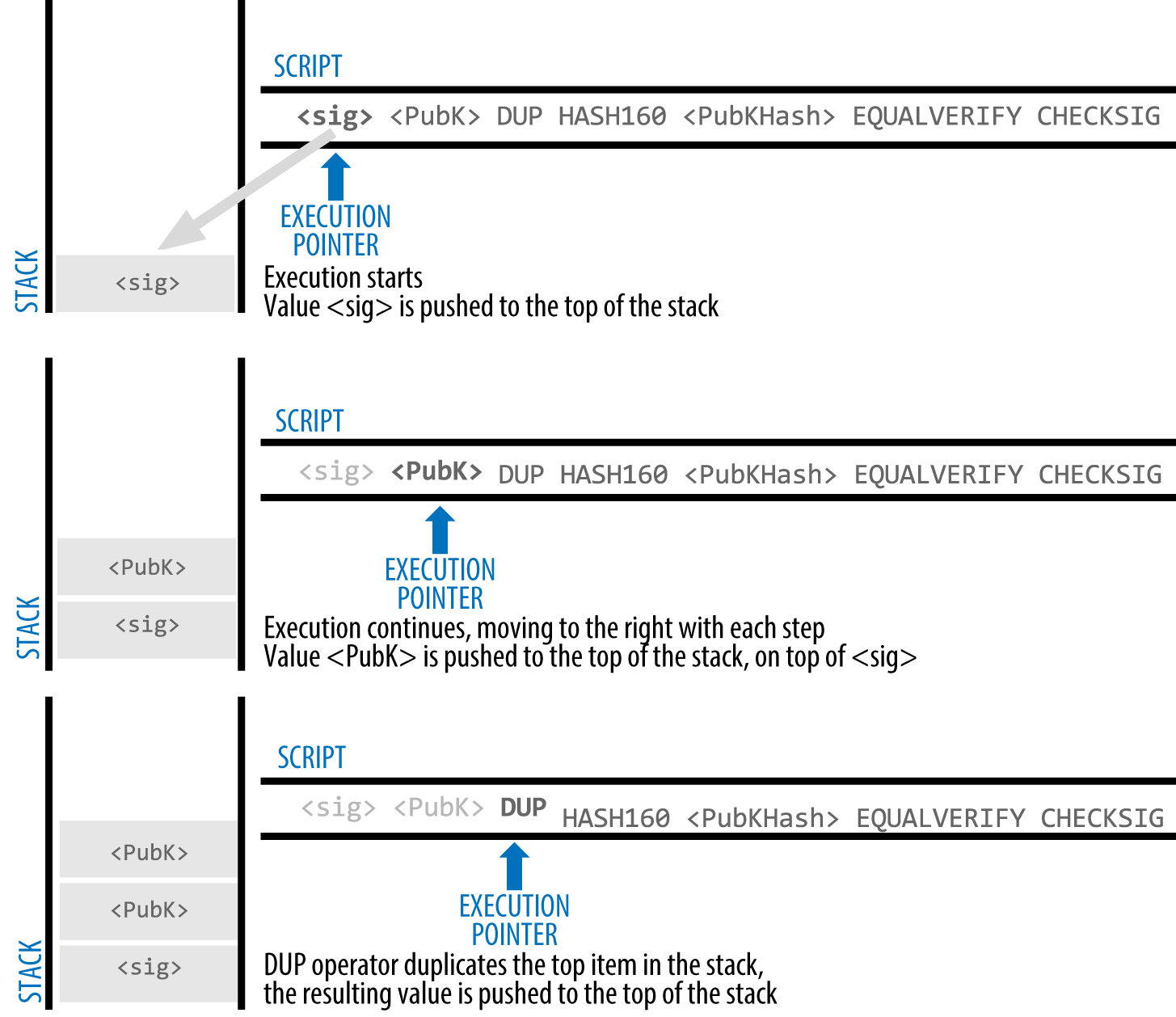

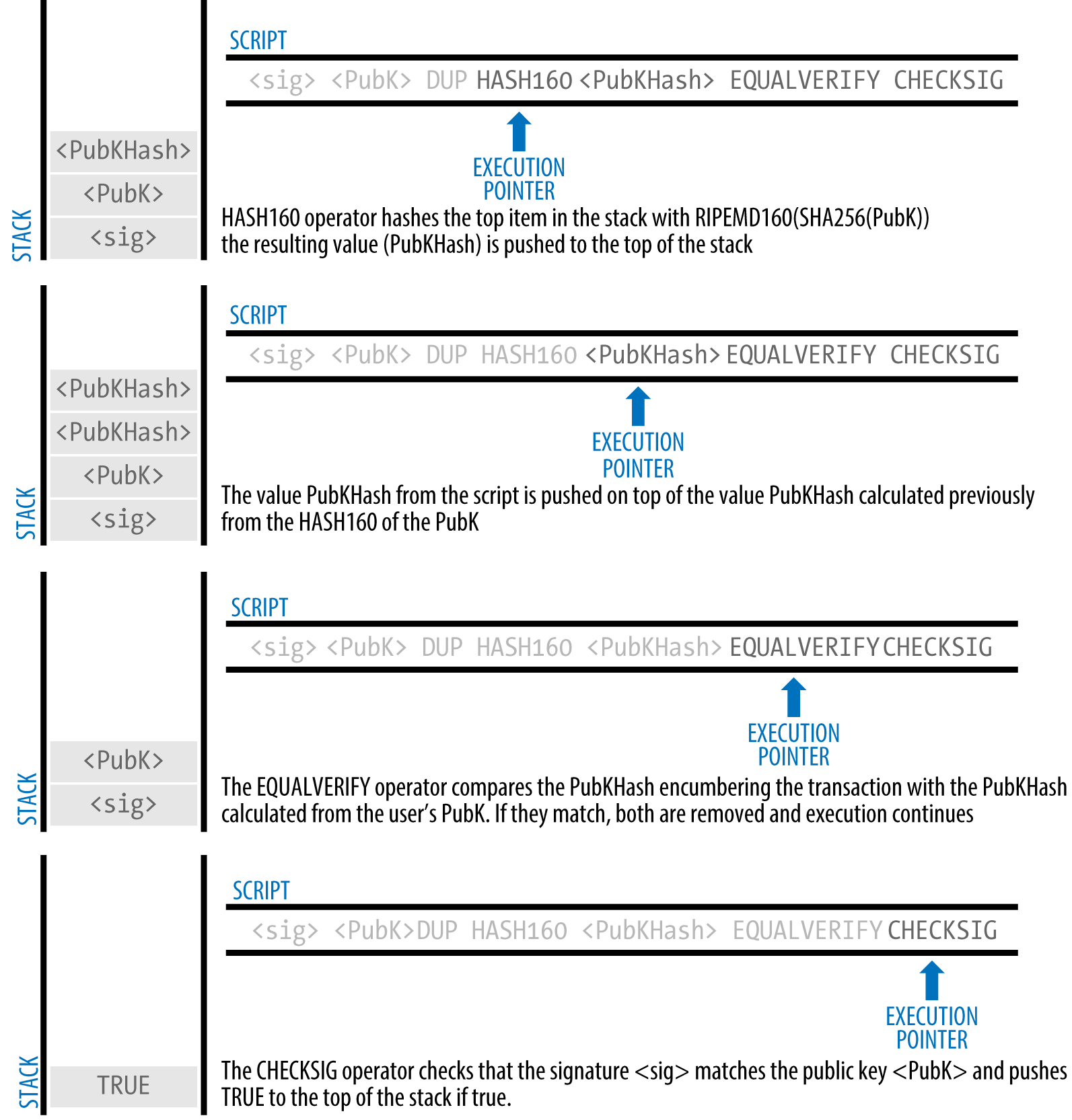

The vast majority of transactions processed on the Bitcoin Cash network are P2PKH transactions. These contain a locking script that encumbers the output with a public key hash, more commonly known as a Bitcoin Cash address. Transactions that pay a Bitcoin Cash address contain P2PKH scripts. An output locked by a P2PKH script can be unlocked (spent) by presenting a public key and a digital signature created by the corresponding private key.

For example, let’s look at Alice’s payment to Bob’s Cafe again. Alice made a payment of 0.00208507 Bitcoin Cash to the cafe’s Bitcoin Cash address. That transaction output would have a locking script of the form:

OP_DUP OP_HASH160 <Cafe Public Key Hash> OP_EQUAL OP_CHECKSIG

The Cafe Public Key Hash is equivalent to the Bitcoin Cash address of the cafe, without the Base58Check encoding. Most applications would show the public key hash in hexadecimal encoding and not the familiar Bitcoin Cash address Base58Check format that begins with a “1”.

The preceding locking script can be satisfied with an unlocking script of the form:

<Cafe Signature> <Cafe Public Key>

The two scripts together would form the following combined validation script:

<Cafe Signature> <Cafe Public Key> OP_DUP OP_HASH160

<Cafe Public Key Hash> OP_EQUAL OP_CHECKSIG

When executed, this combined script will evaluate to TRUE if, and only if, the unlocking script matches the conditions set by the locking script. In other words, the result will be TRUE if the unlocking script has a valid signature from the cafe’s private key that corresponds to the public key hash set as an encumbrance.

Figures and show (in two parts) a step-by-step execution of the combined script, which will prove this is a valid transaction.

Pay-to-Public-Key

Pay-to-public-key is a simpler form of a Bitcoin Cash payment than pay-to-public-key-hash. With this script form, the public key itself is stored in the locking script, rather than a public-key-hash as with P2PKH earlier, which is much shorter. Pay-to-public-key-hash was invented by Satoshi to make Bitcoin Cash addresses shorter, for ease of use. Pay-to-public-key is now most often seen in coinbase transactions, generated by older mining software that has not been updated to use P2PKH.

A pay-to-public-key locking script looks like this:

<Public Key A> OP_CHECKSIG

The corresponding unlocking script that must be presented to unlock this type of output is a simple signature, like this:

<Signature from Private Key A>

The combined script, which is validated by the transaction validation software, is:

<Signature from Private Key A> <Public Key A> OP_CHECKSIG

This script is a simple invocation of the CHECKSIG operator, which validates the signature as belonging to the correct key and returns TRUE on the stack.

Multi-Signature

Multi-signature scripts set a condition where N public keys are recorded in the script and at least M of those must provide signatures to release the encumbrance. This is also known as an M-of-N scheme, where N is the total number of keys and M is the threshold of signatures required for validation. For example, a 2-of-3 multi-signature is one where three public keys are listed as potential signers and at least two of those must be used to create signatures for a valid transaction to spend the funds. At this time, standard multi-signature scripts are limited to at most 15 listed public keys, meaning you can do anything from a 1-of-1 to a 15-of-15 multi-signature or any combination within that range. The limitation to 15 listed keys might be lifted by the time this book is published, so check the isStandard() function to see what is currently accepted by the network.

The general form of a locking script setting an M-of-N multi-signature condition is:

M <Public Key 1> <Public Key 2> ... <Public Key N> N OP_CHECKMULTISIG

where N is the total number of listed public keys and M is the threshold of required signatures to spend the output.

A locking script setting a 2-of-3 multi-signature condition looks like this:

2 <Public Key A> <Public Key B> <Public Key C> 3 OP_CHECKMULTISIG

The preceding locking script can be satisfied with an unlocking script containing pairs of signatures and public keys:

OP_0 <Signature B> <Signature C>

or any combination of two signatures from the private keys corresponding to the three listed public keys.

The two scripts together would form the combined validation script:

OP_0 <Signature B> <Signature C> 2 <Public Key A> <Public Key B> <Public Key C> 3 OP_CHECKMULTISIG

When executed, this combined script will evaluate to TRUE if, and only if, the unlocking script matches the conditions set by the locking script. In this case, the condition is whether the unlocking script has a valid signature from the two private keys that correspond to two of the three public keys set as an encumbrance.

Data Output (OP_RETURN)

Bitcoin Cash’s distributed and timestamped ledger, the blockchain, has potential uses far beyond payments. Many developers have tried to use the transaction scripting language to take advantage of the security and resilience of the system for applications such as digital notary services, stock certificates, and smart contracts. Early attempts to use Bitcoin Cash’s script language for these purposes involved creating transaction outputs that recorded data on the blockchain; for example, to record a digital fingerprint of a file in such a way that anyone could establish proof-of-existence of that file on a specific date by reference to that transaction.

The use of Bitcoin Cash’s blockchain to store data unrelated to Bitcoin Cash payments is a controversial subject. Many developers consider such use abusive and want to discourage it. Others view it as a demonstration of the powerful capabilities of blockchain technology and want to encourage such experimentation. Those who object to the inclusion of non-payment data argue that it causes “blockchain bloat,” burdening those running full Bitcoin Cash nodes with carrying the cost of disk storage for data that the blockchain was not intended to carry. Moreover, such transactions create UTXO that cannot be spent, using the destination Bitcoin Cash address as a free-form 20-byte field. Because the address is used for data, it doesn’t correspond to a private key and the resulting UTXO can never be spent; it’s a fake payment. These transactions that can never be spent are therefore never removed from the UTXO set and cause the size of the UTXO database to forever increase, or “bloat.”

A compromise was reached with the introduction of the OPRETURN operator. OP_RETURN allows developers to add 220 bytes of nonpayment data to a transaction output. However, unlike the use of “fake” UTXO, the OP_RETURN operator creates an explicitly _provably unspendable output, which does not need to be stored in the UTXO set. OP_RETURN outputs are recorded on the blockchain, so they consume disk space and contribute to the increase in the blockchain’s size, but they are not stored in the UTXO set and therefore do not bloat the UTXO memory pool and burden full nodes with the cost of more expensive RAM.

OP_RETURN scripts look like this:

OP_RETURN <data>

The data portion is limited to 220 bytes and most often represents a hash, such as the output from the SHA256 algorithm (32 bytes). Many applications put a prefix in front of the data to help identify the application per the Terab 4-byte prefix guideline for OP_RETURN on Bitcoin Cash.

Keep in mind that there is no “unlocking script” that corresponds to OPRETURN that could possibly be used to “spend” an OP_RETURN output. The whole point of OP_RETURN is that you can’t spend the money locked in that output, and therefore it does not need to be held in the UTXO set as potentially spendable—OP_RETURN is _provably un-spendable. OP_RETURN is usually an output with a zero Bitcoin Cash amount, because any Bitcoin Cash assigned to such an output is effectively lost forever. If an OP_RETURN is encountered by the script validation software, it results immediately in halting the execution of the validation script and marking the transaction as invalid. Thus, if you accidentally reference an OP_RETURN output as an input in a transaction, that transaction is invalid.

A standard transaction (one that conforms to the isStandard() checks) can have only one OP_RETURN output. However, a single OP_RETURN output can be combined in a transaction with outputs of any other type.

Pay-to-Script-Hash (P2SH)

Pay-to-script-hash (P2SH) was introduced in 2012 as a powerful new type of transaction that greatly simplifies the use of complex transaction scripts. To explain the need for P2SH, let’s look at a practical example.

In What is Bitcoin Cash we introduced Mohammed, an electronics importer based in Dubai. Mohammed’s company uses Bitcoin Cash’s multi-signature feature extensively for its corporate accounts. Multi-signature scripts are one of the most common uses of Bitcoin Cash’s advanced scripting capabilities and are a very powerful feature. Mohammed’s company uses a multi-signature script for all customer payments, known in accounting terms as “accounts receivable,” or AR. With the multi-signature scheme, any payments made by customers are locked in such a way that they require at least two signatures to release, from Mohammed and one of his partners or from his attorney who has a backup key. A multi-signature scheme like that offers corporate governance controls and protects against theft, embezzlement, or loss.

The resulting script is quite long and looks like this:

2 <Mohammed’s Public Key>

Although multi-signature scripts are a powerful feature, they are cumbersome to use. Given the preceding script, Mohammed would have to communicate this script to every customer prior to payment. Each customer would have to use special Bitcoin Cash wallet software with the ability to create custom transaction scripts, and each customer would have to understand how to create a transaction using custom scripts. Furthermore, the resulting transaction would be about five times larger than a simple payment transaction, because this script contains very long public keys. The burden of that extra-large transaction would be borne by the customer in the form of fees. Finally, a large transaction script like this would be carried in the UTXO set in RAM in every full node, until it was spent. All of these issues make using complex output scripts difficult in practice.

Pay-to-script-hash (P2SH) was developed to resolve these practical difficulties and to make the use of complex scripts as easy as a payment to a Bitcoin Cash address. With P2SH payments, the complex locking script is replaced with its digital fingerprint, a cryptographic hash. When a transaction attempting to spend the UTXO is presented later, it must contain the script that matches the hash, in addition to the unlocking script. In simple terms, P2SH means “pay to a script matching this hash, a script that will be presented later when this output is spent.”

In P2SH transactions, the locking script that is replaced by a hash is referred to as the redeem script because it is presented to the system at redemption time rather than as a locking script. Complex script without P2SH shows the script without P2SH and Complex script as P2SH shows the same script encoded with P2SH.

Locking Script: 2 PubKey1 PubKey2 PubKey3 PubKey4 PubKey5 5 OP_CHECKMULTISIG Unlocking Script: Sig1 Sig2

Redeem Script: 2 PubKey1 PubKey2 PubKey3 PubKey4 PubKey5 5 OP_CHECKMULTISIG Locking Script: OP_HASH160 <20-byte hash of redeem script> OP_EQUAL Unlocking Script: Sig1 Sig2 redeem script

As you can see from the tables, with P2SH the complex script that details the conditions for spending the output (redeem script) is not presented in the locking script. Instead, only a hash of it is in the locking script and the redeem script itself is presented later, as part of the unlocking script when the output is spent. This shifts the burden in fees and complexity from the sender to the recipient (spender) of the transaction.

Let’s look at Mohammed’s company, the complex multi-signature script, and the resulting P2SH scripts.

First, the multi-signature script that Mohammed’s company uses for all incoming payments from customers:

2 <Mohammed's Public Key> <Partner1 Public Key> <Partner2 Public Key> <Partner3 Public Key> <Attorney Public Key> 5 OP_CHECKMULTISIG

If the placeholders are replaced by actual public keys (shown here as 520-bit numbers starting with 04) you can see that this script becomes very long:

2

04C16B8698A9ABF84250A7C3EA7EEDEF9897D1C8C6ADF47F06CF73370D74DCCA01CDCA79DCC5C395D7EEC6984D83F1F50C900A24DD47F569FD4193AF5DE762C58704A2192968D8655D6A935BEAF2CA23E3FB87A3495E7AF308EDF08DAC3C1FCBFC2C75B4B0F4D0B1B70CD2423657738C0C2B1D5CE65C97D78D0E34224858008E8B49047E63248B75DB7379BE9CDA8CE5751D16485F431E46117B9D0C1837C9D5737812F393DA7D4420D7E1A9162F0279CFC10F1E8E8F3020DECDBC3C0DD389D99779650421D65CBD7149B255382ED7F78E946580657EE6FDA162A187543A9D85BAAA93A4AB3A8F044DADA618D087227440645ABE8A35DA8C5B73997AD343BE5C2AFD94A5043752580AFA1ECED3C68D446BCAB69AC0BA7DF50D56231BE0AABF1FDEEC78A6A45E394BA29A1EDF518C022DD618DA774D207D137AAB59E0B000EB7ED238F4D800 5 OP_CHECKMULTISIG

This entire script can instead be represented by a 20-byte cryptographic hash, by first applying the SHA256 hashing algorithm and then applying the RIPEMD160 algorithm on the result. The 20-byte hash of the preceding script is:

54c557e07dde5bb6cb791c7a540e0a4796f5e97e

A P2SH transaction locks the output to this hash instead of the longer script, using the locking script:

OP_HASH160 54c557e07dde5bb6cb791c7a540e0a4796f5e97e OP_EQUAL

which, as you can see, is much shorter. Instead of “pay to this 5-key multi-signature script,” the P2SH equivalent transaction is “pay to a script with this hash.” A customer making a payment to Mohammed’s company need only include this much shorter locking script in his payment. When Mohammed wants to spend this UTXO, they must present the original redeem script (the one whose hash locked the UTXO) and the signatures necessary to unlock it, like this:

<Sig1> <Sig2> <2 PK1 PK2 PK3 PK4 PK5 5 OP_CHECKMULTISIG>

The two scripts are combined in two stages. First, the redeem script is checked against the locking script to make sure the hash matches:

<2 PK1 PK2 PK3 PK4 PK5 5 OP_CHECKMULTISIG> OP_HASH160 <redeem scriptHash> OP_EQUAL

If the redeem script hash matches, the unlocking script is executed on its own, to unlock the redeem script:

<Sig1> <Sig2> 2 PK1 PK2 PK3 PK4 PK5 5 OP_CHECKMULTISIG

Pay-to-script-hash addresses

Another important part of the P2SH feature is the ability to encode a script hash as an address, as defined in BIP0013. P2SH addresses are Base58Check encodings of the 20-byte hash of a script, just like Bitcoin Cash addresses are Base58Check encodings of the 20-byte hash of a public key. P2SH addresses use the version prefix “5”, which results in Base58Check-encoded addresses that start with a “3”. For example, Mohammed’s complex script, hashed and Base58Check-encoded as a P2SH address becomes 39RF6JqABiHdYHkfChV6USGMe6Nsr66Gzw. Now, Mohammed can give this “address” to his customers and they can use almost any Bitcoin Cash wallet to make a simple payment, as if it were a Bitcoin Cash address. The 3 prefix gives them a hint that this is a special type of address, one corresponding to a script instead of a public key, but otherwise it works in exactly the same way as a payment to a Bitcoin Cash address.

P2SH addresses hide all of the complexity, so that the person making a payment does not see the script.

Benefits of pay-to-script-hash

The pay-to-script-hash feature offers the following benefits compared to the direct use of complex scripts in locking outputs:

- Complex scripts are replaced by shorter fingerprints in the transaction output, making the transaction smaller.

- Scripts can be coded as an address, so the sender and the sender’s wallet don’t need complex engineering to implement P2SH.

- P2SH shifts the burden of constructing the script to the recipient, not the sender.

- P2SH shifts the burden in data storage for the long script from the output (which is in the UTXO set) to the input (stored on the blockchain).

- P2SH shifts the burden in data storage for the long script from the present time (payment) to a future time (when it is spent).

- P2SH shifts the transaction fee cost of a long script from the sender to the recipient, who has to include the long redeem script to spend it.

Redeem script and isStandard validation

Prior to version 0.9.2, pay-to-script-hash was limited to the standard types of Bitcoin Cash transaction scripts, by the isStandard() function. That means that the redeem script presented in the spending transaction could only be one of the standard types: P2PK, P2PKH, or multi-sig nature, excluding OP_RETURN and P2SH itself.

As of version 0.9.2, P2SH transactions can contain any valid script, making the P2SH standard much more flexible and allowing for experimentation with many novel and complex types of transactions.

Note that you are not able to put a P2SH inside a P2SH redeem script, because the P2SH specification is not recursive. You are also still not able to use OP_RETURN in a redeem script because OP_RETURN cannot be redeemed by definition.

Note that because the redeem script is not presented to the network until you attempt to spend a P2SH output, if you lock an output with the hash of an invalid transaction it will be processed regardless. However, you will not be able to spend it because the spending transaction, which includes the redeem script, will not be accepted because it is an invalid script. This creates a risk, because you can lock Bitcoin Cash in a P2SH that cannot be spent later. The network will accept the P2SH encumbrance even if it corresponds to an invalid redeem script, because the script hash gives no indication of the script it represents.